Hello Friends 👋

Today we are going to discuss the fresh updates related to the Indian Stock Market—specially quite useful for the medium term investors/traders. In this, we are going to cover unique swing trading setup (Q Power), dividend announcements, bonus and stock split news, and latest analyst reports. Let’s understand each and every topic in detail, so that taking the portfolio decision becomes easier.

🔥 Swing Trading Setup: Quality Power Electrical Equipments (Q Power)

📌 Company Introduction

Quality Power Electrical Equipments (Q Power) is a established player in the electrical manufacturing industry. Company product is mainly focused on electrical and power sectors, where the demands always remain stable. In the Power sectors, regular orders are received from the government projects, private contracts and from the infrastructure expansion, which helps the business to sustain in the long-term.

📊 Market Move

In today trading session Q Power has showed the tremendous strength—stock rose 7% up and closes at ₹870. This is a strong bullish signal. The most interesting thing is that the level market of ₹860 is assumes to be strong support zone. Meaning even if the stock fell blow, then the buyers around ₹860 would become active and price could bounce back. And that is what happened—stock respected the support.

🎯 Swing Levels

In swing trading, It is important to clear to your entry and exit point:

- Support Zone (Stop Loss Area): ₹860

If the stock goes below this, then the swing trade will become weak. - Immediate Resistance (Target Zone): ₹940

This may become hurdle for the short-term, but if it breaks then there is a chances of upside also. - Short-Term Target: ₹940

Means from 2 to 20 days, there is a chance that this stock reach here.

✅ Investor POV

For the swing traders, Q Power looks like a attractive setup, because:

- Support is clear (risk is manageable ).

- Upside potential is visible in the short-term trade.

- Sector is also demand-driven, which gives strength to the stock.

Note: Swing trading’s time frame is for short holding period (2–20 days), and Q Power fit in this criteria quite well.

💰 Dividend Announcements — Simple and Practical Explanation

The company gives a portion of its profit to its shareholder in the form of cash (or sometimes in the form of stock) — This is a reward for the long-term investors or income-seekers.

Types:

- Interim dividend: It is given in the middle of the Financial year.

- Final dividend: It is approved after the Annual results through the board/AGM.

- Special dividend: One-off, when the company distribute extra cash.

Important dates:

- Record Date (which you gave): The company decide that which shareholder will register on which date — those whose name is register will get the dividend (Company/exchange also announces the ex-dividend date — check the exact or ex-date)

- Payable Date: when the actual dividend comes to your account.

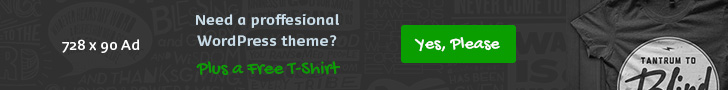

🏭 Finolex Industries

- Sector: PVC Pipes

- Closing Price: ₹217

- Dividend: ₹3.60 per share (₹2 + ₹1.60)

- Dividend Yield: 1.66%

- 100 Shares Return: ₹360 dividend

Example: If you have 100 shares, then you will get ₹360 as a dividend. The dividend yield is also solid at this price.

👕 Ruby Mills

- Sector: Textile

- Closing Price: ₹225

- Dividend: ₹1.75 per share

- Dividend Yield: 0.78%

- 100 Shares Return: ₹175 dividend

Note: Ruby Mills pays consistently dividend despite of volatile in textile sector—this is what build trust amongst the investors.

⚡ Bharat Bijlee

- Sector: Electrical Engineering

- Closing Price: ₹329

- Dividend: ₹35 per share

- Dividend Yield: 10.64% (High)

- 100 Shares Return: ₹3,500 dividend

Note: you will get the dividend of ₹35 on the share of ₹329—which is very rare with such high payout! This is strong for the long-term investors.

🎁 Bonus Share Announcements

Bonus shares means company gives free additional shares to its existing shareholders, in proportion to the share already held by them. This improves the both company’s goodwill and investor confidence. After the bonus issue, the price of the stock generally adjusts, but there is no difference on the total investment value. These step is used to increase liquidity in the market and is also considered as a positive signal for the long-term investors.

Patanjali Foods

- Sector: FMCG & Food Processing.

- Today’s Move: +6%

- Closing Price: ₹1840 (approx)

- Bonus Ratio: 2:1 (you get 2 bonus shares for every 1 you own)

- Record Date: 11th September

Example: 1 If you have 1 share then you get 2 extra share means total 3 share(1 existing + 2 bonus).

After the bonus, the price will automatically adjusts, but in long-term, your total numbers of share increase —a win win situation for the retail investors.

Tip: In bonus issue, holding is mandatory on the record date.

📉 Stock Split Announcement

Stock split is a process in which company divides its share into smaller denominations, for example 1:10 split means you will get 10 share in exchange of 1 share. This will reduce both the face value and market price of the share proportionate, but the value of the total investment remain the same. This step increases the liquidity in the market and make buying these stock more affordable even for the smaller investors.

AB Infrabuild

- Sector: Infrastructure & Real Estate

- Today’s Move: +4.5%

- Closing Price: ₹203

- Split Ratio: 1:10

- Record Date: Pending

Example: 10 shares will be split into 100 shares and price will be adjust but the number of share increase. Stocks split brings more buying interest in the market—and volume also increase.

📊 Market-Linked Stocks: NSDL, Vedanta & Hindustan Zinc

The analyst report on Market infrastructure and commodity stocks will be very crucial for the short-term investors. The analyst have highlighted that demand recovery and global price will have the direct impact in the coming 1 or 2 months. In the infrastructure stocks, government spending is a key driver while in the commodity stocks, international supply-demand and currency movement play a major role. Both of these segment become important for portfolio diversification and trading opportunities.

1️⃣ NSDL (National Securities Depository Limited)

- Closing Price: ₹1277

- Report by: JLL

- Target: ₹1340

- Outlook: Positive

Note: NSDL, CDSL, BSE, MCX—these all are the market-related stocks—these stocks outperform when the market activity increases, especially when the demat account opening is quite good.

2️⃣ Vedanta Limited

- Sector: Metals, Mining, Oil & Gas

- Closing Price: ₹431

- Report: Choice Broking

- Support: ₹400

- Resistance: ₹450

- Target: ₹452

Note: Vedanta is currently in the sideways range. if it break at ₹450 then the target is ₹452. The metals sectors are in the revival mode now— a potential for the momentum traders.

3️⃣ Hindustan Zinc

- Sector: Metal & Mining (Zinc, Lead, Silver)

- Closing Price: ₹440

- Report by: Axis Securities

- Target: ₹468

Note: Stock is near its support, fresh buying can be seen. Institutional buying is a strong signal. Movement upto ₹468 is possible.

🔑 Key Insights for Investors

- Swing Trade Pick: Q Power is the super setup for the short-term swing traders.

- Dividend Opportunities: Finolex ₹3.6, Ruby Mills ₹1.75, Bharat Bijlee ₹35.

- Bonus/Split Plays: Patanjali Foods bonus 2:1, AB Infrabuild split 1:10.

- Analyst Targets: NSDL ₹1340, Vedanta breakout at ₹452, Hindustan Zinc ₹468.

Investor Tip: All these opportunities are for the current state, but take the final decision after consulting a financial advisor.

📌 Final Words

Stock market become the source of daily opportunity—but the most important things is research and the timely news. In this article, we have seen how dividend, bonus, split and swing picks build the portfolio. Apart from this, we also understand the analyst viewpoint on the market-linked stocks.

👉 Important:This article only for the educational and awareness purpose, before taking any trade/position definitely consult your advisor. Market is volatile and it work on the risk management.