Once again the season of IPO has come! and this time the spotlight is on the pharma sector—Amanta Healthcare Ltd IPO. In this article, we are going to see if this will be genuinely rewarding for the retail and HNI investors or not? The focus on both the angles: the scope of short-term listing gains and the fundamentals of long-term portfolio value like the—growth, margins, aur valuation. Apart from this, we are also going to simplify the subscription trend, GMP sentiment, and key highlights of the DRHP/RHP which is very helpful for the beginners. So let’s start to dive deep into each section-by-section—that helps you to take informed decision based on the data, not hype.

🏥 Company Profile & Business Model – Amanta Healthcare IPO Details

Amanta Healthcare Ltd, which was incorporated in 1994, is a reputed pharmaceutical manufacturer, which specializes in IV fluids, sterile medicines, respiratory and ophthalmic products. There is a constant demand of their company product in hospital emergency rooms, surgeries and critical care units, which gives a stable business model to this company. The company has already expanded their footprint to 21 countries and has a strong presence in India through a strong network of 320+ distributors.

The journey of the company is not so simple so far—There are so many ups and down of the pharma industry during the Covid, which had the direct impact on Amanta Healthcare Ltd as well. In the phase of 2024-2025, the company has showed a major turnaround, in which a sharp improvement has been seen in both operations and financial performance as well. This recovery just not only rebuild the trust but also highlights the long-term potential growth.

📅 Amanta Healthcare IPO Details & Listing Date

| Event / Detail | Information |

|---|---|

| IPO Open | 1st September 2025 |

| IPO Close | 3rd September 2025 |

| Allotment Date | 4th September 2025 |

| Refund / Shares Credit | 8th September 2025 |

| Listing Date | 9th September 2025 (NSE & BSE) |

| Price Band | ₹120 – ₹126 |

| Lot Size | 119 shares (~₹14,994 minimum investment) |

| IPO Size | ₹126 Crore (Small Issue) |

| Categories | QIB (50%), Retail (35%), HNI (15%) |

| Book Running Lead Manager | Beeline Capital Advisors |

Note: Being a small IPO means strong chances of oversubscription— there is a chances of becoming a bullish indicator for the retail and HNI categories.

💊 Pharma Sector Analysis – Amanta Healthcare IPO Analysis

The Pharma sector is generally considered as a cyclical sector but with a important difference – it’s demand is never zero. Especially when it comes to critical medical supplies like IV fluids and emergency medicines, their consumption always remain consistent.

- Pre-Covid Era (2015–2019): During this phase, the growth of Indian pharma Industry is at very slow rate. USFDA had become very strict, which put pressure on the export and regulatory hurdles also squeezed profitability. And Amanta Healthcare also facing these challenges.

- Covid Boom (2020–2022): When the pandemic struck, the demand literally exploded. The requirement of IV fluids and sterile medicines had increased to the record level. Amanta Industry also showed its peak performance and during this period, the company made the profit of +40 crore, which is considered as its the golden phase.

- Post-Covid Phase (2023–2024): After the pandemic, demands started being normalize and due to oversupply, the margins of pharma companies fall. And Amanta industry also had to see losses in this phase. But the management took the decision precisely and timely like—cost cutting, operational efficiency and supply chain restructuring—which brought back the company in the profit zone by 2024-2025 and created a strong comeback story.

👉 From this It is important to understand sectoral cycles while evaluating the pharma stock. Despite of just focusing on short-term boom, you should always focus on long term sustainability and crisis-handling capacity the company.

📊 Amanta Healthcare Financials – Detailed Analysis

While evaluating the IPO, it is important to understand the company’s financials and ratios. Let’s understand step by step what the number of Amanta Healthcare means 👇

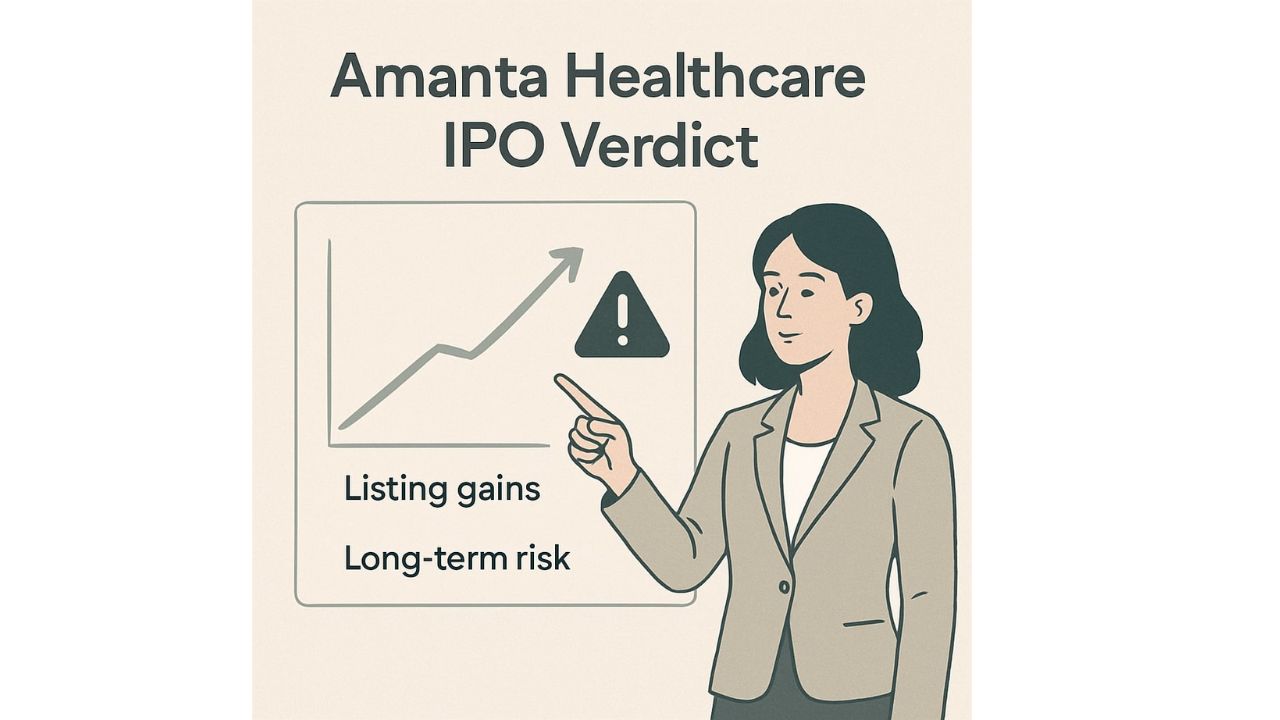

🏦 Balance Sheet Position

- Assets (2025): ₹381 Crore

This means that the company has total resources and investments of around ₹381 Cr. This is a strong asset base which shows that company has its own resource to build its scale. - Borrowings: ₹195 Crore

Company has a debt of ₹195 Cr. If we see the debt in comparison with equity, then the Debt-to-Equity Ratio >2.

👉Simply, this means that the company has the taken more the double the loan amount that the company has money from its own investor, and this is the risky side because due to more debt, the interest pressure also increases.

💰 Revenue and Profitability

- Revenue (2025): -2% Decline

Meaning sales is stagnant – not much growth is visible. For a growing based company, flat revenue may be a sign for a warning. - PAT (Profit After Tax): +189% Jump

There one positive story is here. There is a huge turnaround in term of profitability.- 2023: Company is in loss.

- 2024: ₹34 Cr profit.

- 2025: ~₹10 Cr profit (profits has fallen, but still in positive)

👉This shows that the management has improves its cost control and company has turnaround from the loss to the profit.

📌 Key Ratios Explained

- ROE (Return on Equity): 12.42%

Meaning that company has earning ₹12.4 profit on every ₹100 equity capital. This is decent but not very high. - ROCE (Return on Capital Employed): 13.72%

Meaning company is generating return of approx 13.7 on the total capital (equity + debt). This is healthy and shows that borrowed funds are being efficiently used. - P/E Ratio: ~34

Meaning market is currently ready to pay 34 times the company’s profit. This is consider as a little expensive valuation, because as usually 20–25 P/E is considered fair in the pharma sector. - Price-to-Book (P/B): 3.82

Meaning that the company’s market price is approx 3.8 times of its book value (assets minus liabilities per share). This is more than the Peer companies, which is little costly in terms of valuation.

⚖️ Peer Comparison & Valuation – Amanta Healthcare IPO Analysis

An important step in IPO analysis is to compare the company against its peer group. This shows that the market valuation is correct or a bit high premium is being charged.

👥 Peer Example: Denis Chem Lab

- RONW (Return on Net Worth): ~9.5%

Means that Denis Chem generates the return of 9.5% of its net worth. This is a moderate performance. - P/E Ratio: 33

Means that market is pricing Denis Chem 33 times of its profit. This is little on high side, but nearly around the industry standard. - Price-to-Book: 1.51

Means that Denis Chem market price is trade around 1.5 times of its book value. This is a very reasonable valuation, especially for the pharma industry.

📊 Amanta Healthcare Valuation

- RONW: ~12.4%

Amanta’s RONW is better than the Denis, means company is generating little more return on its shareholder capital. - P/E Ratio: ~34

Means market is ready to pay 34 times of the profit of Amanta. This is very close to Denis 33, but with a slightly higher premium. - Price-to-Book: 3.82

Here the biggest difference is – Amanta P/B ratio is 2.5 times more than its peers (3.82 vs 1.51). Meaning investor are paying more a mush more amount for Amanta than its book value.

🔎 What Does It Mean?

- Profitability (RONW): Amanta slightly better than the Denis, which is a positive sign.

- Valuation (P/E & P/B): Amanta’s share looks like quite overvalued specially on P/B ratio. Means according to the current earning and book value of company, the price is slightly on the heavy side.

- Investor View: If you are looking for a long-term stable pharma stock, then it is important to justify the valuation. For the short-term, listing gains comes from demand and sentiment, but in the long term growth and debt-reduction will be the key factor.

🎯 Amanta Healthcare IPO Objectives – Funds Utilization

- Capex: For the New plant, upgrades.

- Infrastructure: For the Expansion projects.

- Working Capital: For the Business operations.

Note: This means that IPO money will not go into the debt repayment. The higher debt will be remain in the market for now.

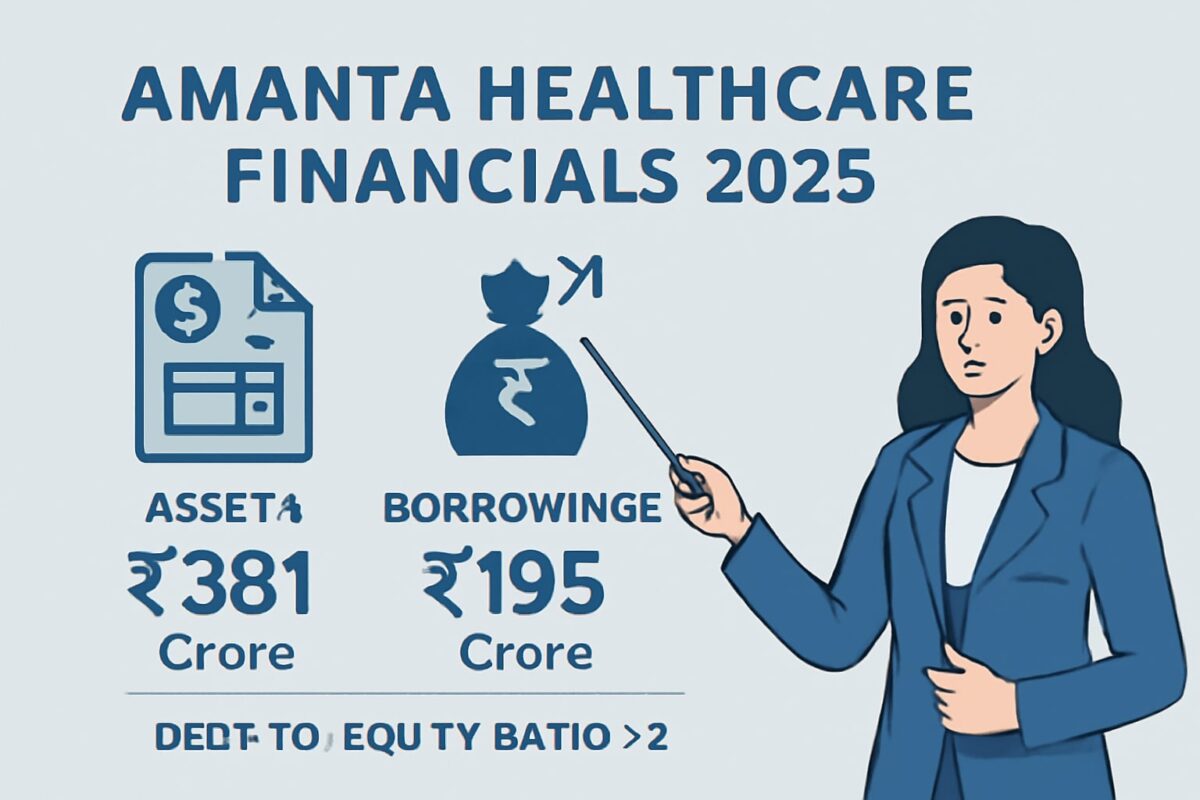

📈 Amanta Healthcare IPO GMP Trend

Latest Grey Market Premium (GMP): ~6-15% (as of listing week)

Due to the strong subscription and small issue size, Listing gain can be expected. GMP changes daily, so it must be good to check at the time of final subscription.

👍 Positives of Amanta Healthcare IPO

- Turnaround Story: Profit after the Loss, the investor sentiment boosted.

- Small IPO Size: Oversubscription chances high (listing gains possibility).

- Pharma Defensive Nature: Market demand stable even in the downturn.

- Affordable Entry: For the Retail, the minimum investment will be under ₹15,000.

- Listing on NSE & BSE: Better liquidity.

- Decent Returns Ratios: ROE and ROCE are okay.

👎 Negatives of Amanta Healthcare IPO

- High Debt: D/E >2, too risky for long-term.

- Overvaluation: costly as compare to the Peer.

- Revenue Growth Missing: Only improvement in the profits.

- Sector Cyclicality: Covid profits, one-time boost, not sustainable

- Recent Profit Track Record: Just 1-2 year turnaround record.

📝 Final Verdict: Amanta Healthcare IPO Should You Invest?

Amanta Healthcare IPO may be a promising options for the short-term investors because of the oversubscription trend and affordable pricing, there is a strong possibility of listing gain up to 10-20%. Being a defensive sector, the demands from the retails investors make this IPO even more attractive. If you want to apply for the quick returns then there is a high chances of good profit.

But for the long-term investors, the fundamentals of this company looks a little weak. High debt burden, premium valuation and lack of growth consistency cannot be ignored. A sector like Pharma is safe but cyclicality and overvaluation increases the risk. So it is better to apply for the listing, but for the long-term investment it will be better to prefer the better established pharma industry players.

Disclaimer: This article is purely for the educational and awareness purpose. Before taking the investment decision, it is better to consult your financial advisor—market risk are always present.