Whenever an IPO of a company comes whose name we have already heard that or whose service we have used at some point, then the excitement level increases even more. With this excitement, today we are going to talk about the Urban Company IPO. This is one of such IPO which is important for both the investors and traders. In this article, we are going to explain from IPO basic details to the advanced financials, valuations, risks and listing strategy, which means everything in simple and easy-to-understand way.

🌟 Company Overview

Urban Company is a tech-driven online services marketplace, which provide the home and beauty service to each and every doorstep. If you have ever taken the service like cleaning, plumbing, electrical work or beauty treatment, then most probably their is a high chances that you have used the Urban company platform.

- Incorporation Year: 2014

- Operations: In around 51 Indian cities + also ative in UAE and Singapore.

- Services Offered:

- Home cleaning.

- Plumbing & electrical repair.

- Appliance maintenance.

- Beauty treatments & massage therapies.

- USP: India’s biggest organized online service provider with tech-enabled platform.

Note: Urban Company has made a monopoly-type position in its sector and also giving a tough competition to their unorganized players.

📈Urban Company IPO Details

Urban Company IPO’s size is quite big and this can be an important opportunity for both the investor and traders:

| Particulars | Details |

|---|---|

| Open Date | 10th September 2025 |

| Close Date | 12th September 2025 |

| Allotment Date | 15th September 2025 |

| Refund / Demat Credit | 16th September 2025 |

| Listing Date | 17th September 2025 |

| Listing | NSE & BSE dono par |

| IPO Size | ₹1900 crore |

| Fresh Issue | ₹472 crore |

| Offer for Sale (OFS) | Balance amount |

| Employee Discount | ₹9 per share |

| Quota Distribution | QIBs: 75% • Retail: 13% • HNIs: 15% |

Note: In this IPO, OFS is quite big, which means promoters are making exit by selling their stakes.

🌐 Grey Market Premium (GMP) – IPO Listing Gains Indicator

Grey Market Premium (GMP) is one of the most popular tool to judge the listing gain of any IPO. This is an unofficial market where IPO share are traded on the basis of demand and supply before the listing.

📈 Current Grey Market Premium (GMP) Updates

- Starting GMP: Currently around 13–15% premium.

- Current GMP (after 7th Sept): With 30%+ premium.

👉 Example: If the issue price of the IPO is ₹100, then it demand in the grey market may be is around ₹130.

⚠️ Important Point to Understand

A lot of hype is created about the GMP on many websites and new portals, but in ground reality:

- IPO applications are being happening on the limited scale.

- Meaning both the demand and sentiments are definitely strong, but it is not necessary that every investors gets the same benefits as according to the GMP.

- GMP is just an a sentiment indicator, but the final listing gain depends on the market conditions and investor participation.

Note: It is important to understand one thing for sure – as much as the hype is there on the online website and news portal, but the application on the ground reality are limited. Meaning GMP is definitely high, but the execution is happening on the limited scale.

📊 Financial Performance

The financial of Urban Company has showed the impressive turnaround even before the IPO:

- FY 2023: Loss-making year.

- FY 2024: Performance improved.

- FY 2025:

- Revenue growth: +36% YoY

- Profit After Tax (PAT): +358% YoY

- EPS: 1.72

- RONW: 13.35%

- Price-to-Book: 8x (high side)

Note: This data clearly shows that company has strengthened its number before the listing.

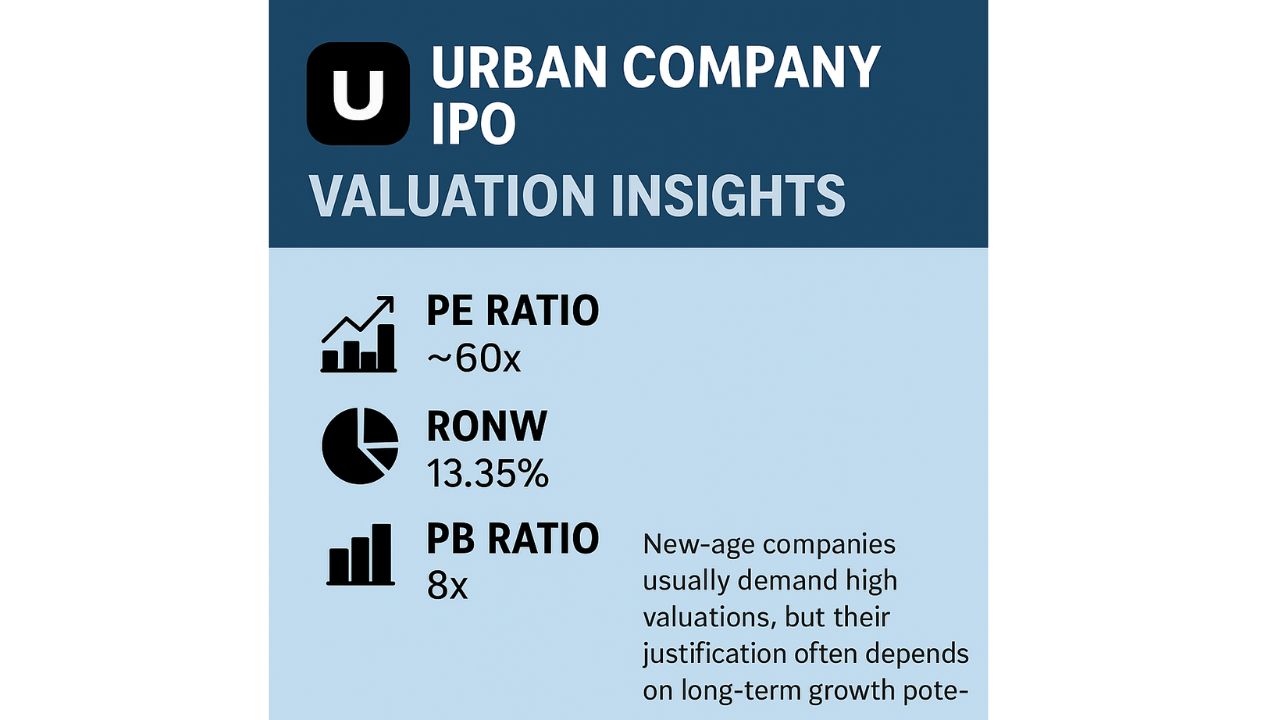

📊 Urban Company IPO – Valuation Insights

Urban Company’s IPO is demanding a premium valuation for its investors. It is very important to understand this valuation so that you can take your investment decision wisely.

🔢 Key Valuation Metrics

- PE Ratio (Price-to-Earnings): ~60x

This clearly shows that the IPO price is set at very premium as compared to the earnings. The PE ration of the traditional companies is usually around the range of 20–30x but the PE of the new-age startups is generally always high. - RONW (Return on Net Worth): 13.35%

This is a decent profitability indicator. Meaning company is generating the return of around 13%+ on its net worth, which gives the signal of the stability. - PB Ratio (Price-to-Book): 8x

The PB ratio is quite high, which means that the market is ready to pay 8x premium as compare over its company’s assets.

🏢 Why New-Age Companies Demand High Valuation?

New-age tech-driven companies like Urban Company usually demands valuation in their IPO and the reason is quite simple:

- Its Business model is scalable.

- Long-term growth potential is quite high.

- Market positioning is unique.

- Investors’s focus on the future earnings and growth story, not just only on the current profit.

🔍 Peer Comparison

Direct listed peer comparison of the Urban Company is not available and the by this reason, it is difficult to compare the valuation with the traditional service-based companies. But if we see the trends of the global service-tech startups, they too had raised capital on the high valuation in the initial years.

Note: The Urban Company IPO’s valuation is in the premium range – Its PE ratio is high, PB ratio is expensive, and RONW is also decent. While deciding, investors will have to evaluate whether they are go for long-term growth story or business scalability.

🔧 Use of IPO Proceeds

According to the DRHP, the IPO funds are being used as:

- Offer for Sale (OFS): Promoters can be exit by selling their stakes.

- Technology Enhancement: To make the Platform even more efficient.

- Lease Payments: For the Offices.

- Marketing & Branding: For the Customer acquisition and awareness.

- General Corporate Purposes.

Note: A large share of OFS gives a caution signal which means that promoters are making the exit.

🔐 GMP vs Ground Reality

- Official GMP: ~30%

- Actual Market Execution: It is running on the limited scale.

This means that if you go with the large-size application then guaranteed you are not getting the listing gain. Listing performance mainly depends on the HNI subscription and anchor investor interest.

📅 Subscription Strategy

- Retail Investors: It is safe to apply for 1–2 lot.

- HNIs: If the subscription looks stronger (10x+), then you can apply for more.

- Anchor Investors: If the anchor book stronger then their is a quite more chances of positive listing.

🌟 Expert Opinion

Urban Company is a unique monopoly-style player in its sector. Its long-term growth potential is very high due to being tech-driven and asset-light business model. But the valuation is slightly expensive and also the size of the OFS is quite big, which create risk.

- Short-term Listing Gains: Chances are strong If the subscription demand is quite good.

- Long-term Investment: It is better to wait and watch and let the valuation settle after the listing.

🔍 Key Takeaways

- IPO Dates: 10th–12th Sept 2025

- Listing Date: 17th Sept 2025

- IPO Size: ₹1900 crore (large OFS).

- GMP: 30% (source-based).

- Valuation: Expensive (PE 60x).

- Strength: India’s biggest and well organized services platform.

- Risks: OFS + is quite high premium demand.

👉 Final Thoughts

Urban Company IPO is a buzzworthy issue which is quite interesting for the retail and HNI investors. There is a possibility of short-term listing gain but fro the long-term investments, valuation still seems to be very expensive. If listing gain is the priority for you then you can apply but if you are a long-term investor, then it is better to wait and have some patience.

Disclaimer: This article is just for the educational and awareness purpose. Before taking the Investment decision, just consult your financial advisor.